Technology

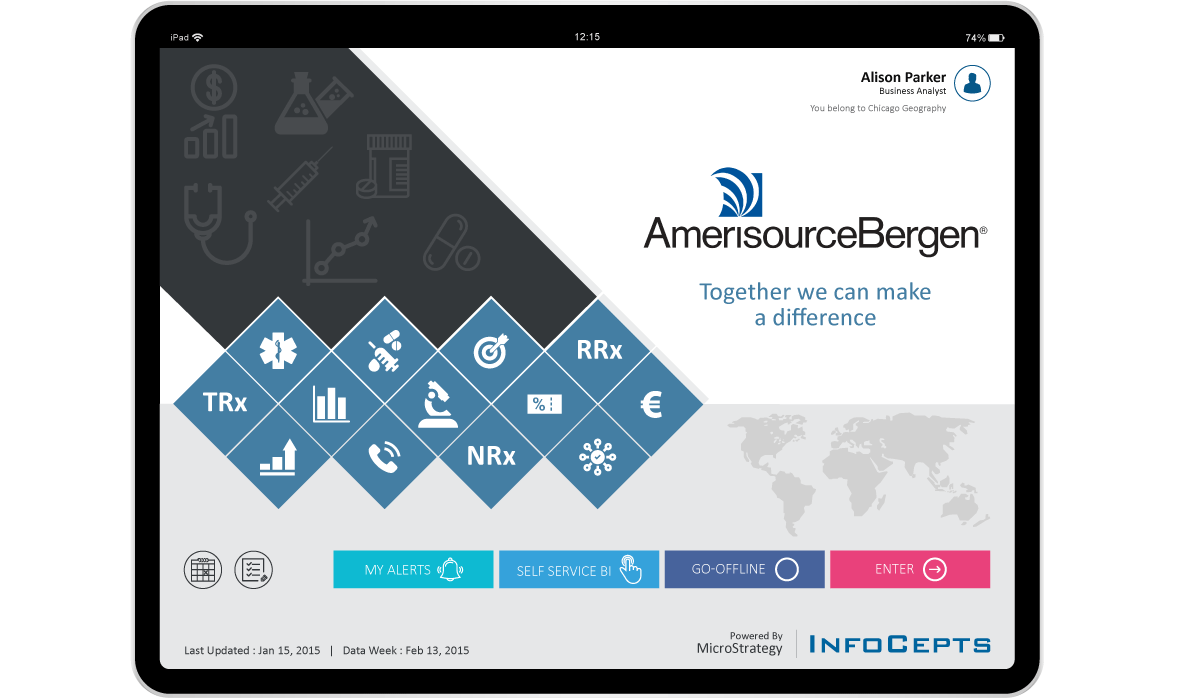

MicroStrategy

Industry BFSI

Platform iPad App

CapabilitiesData Storytelling Design thinking

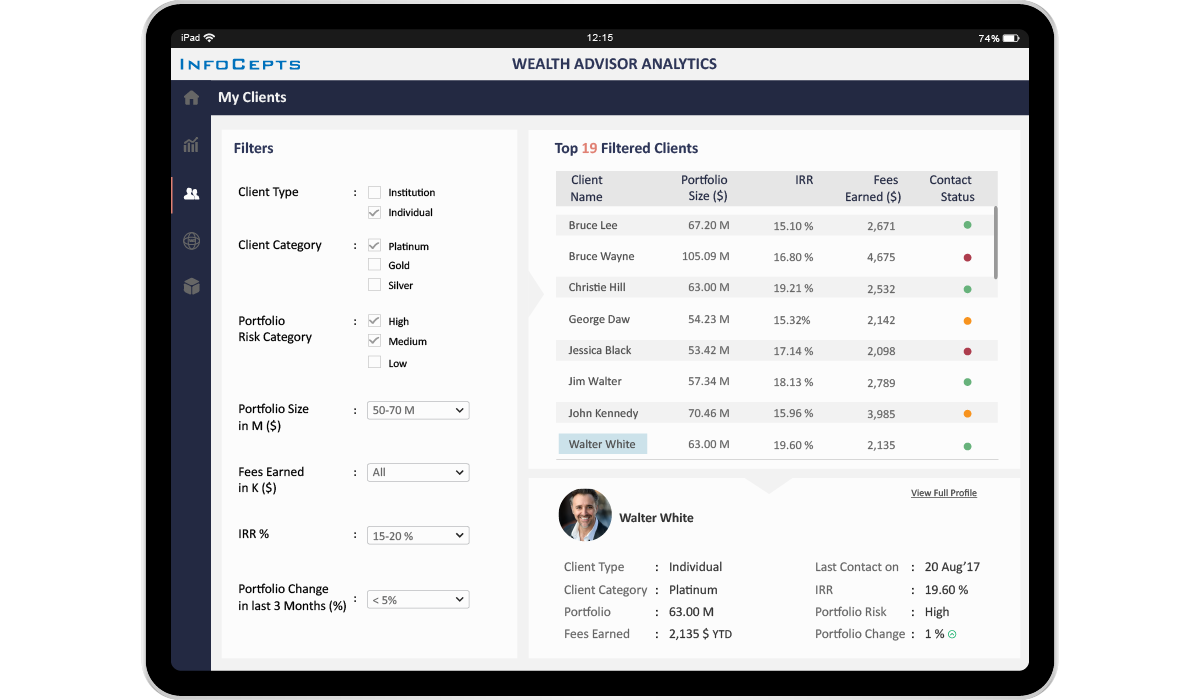

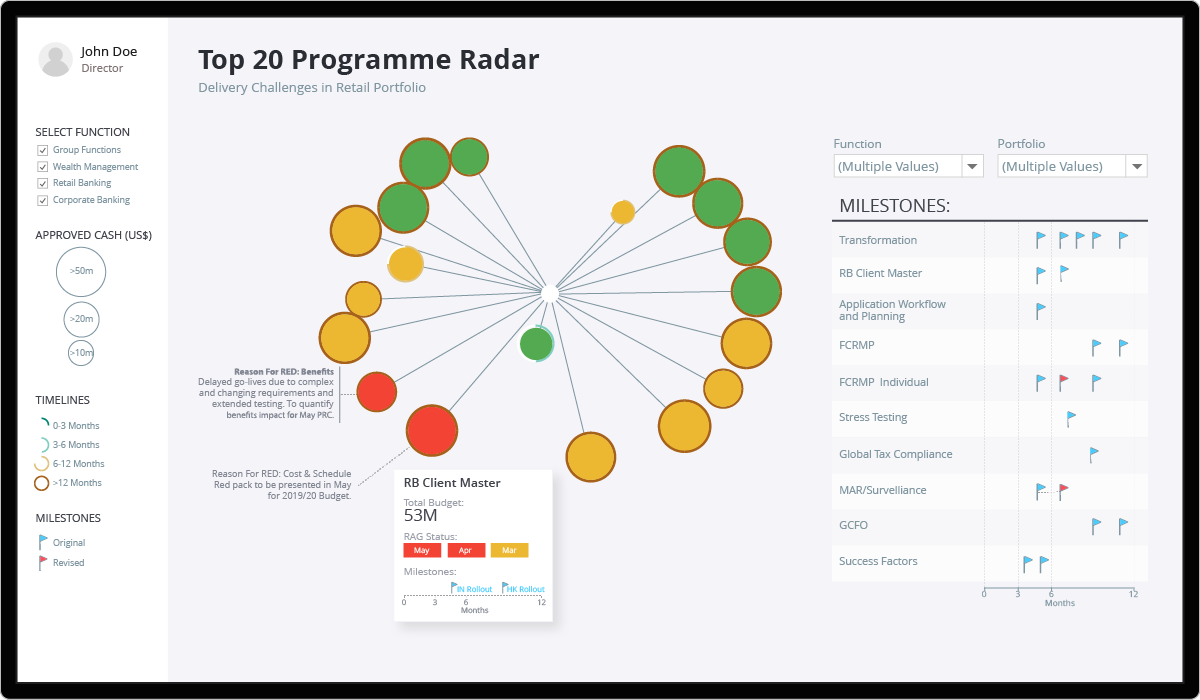

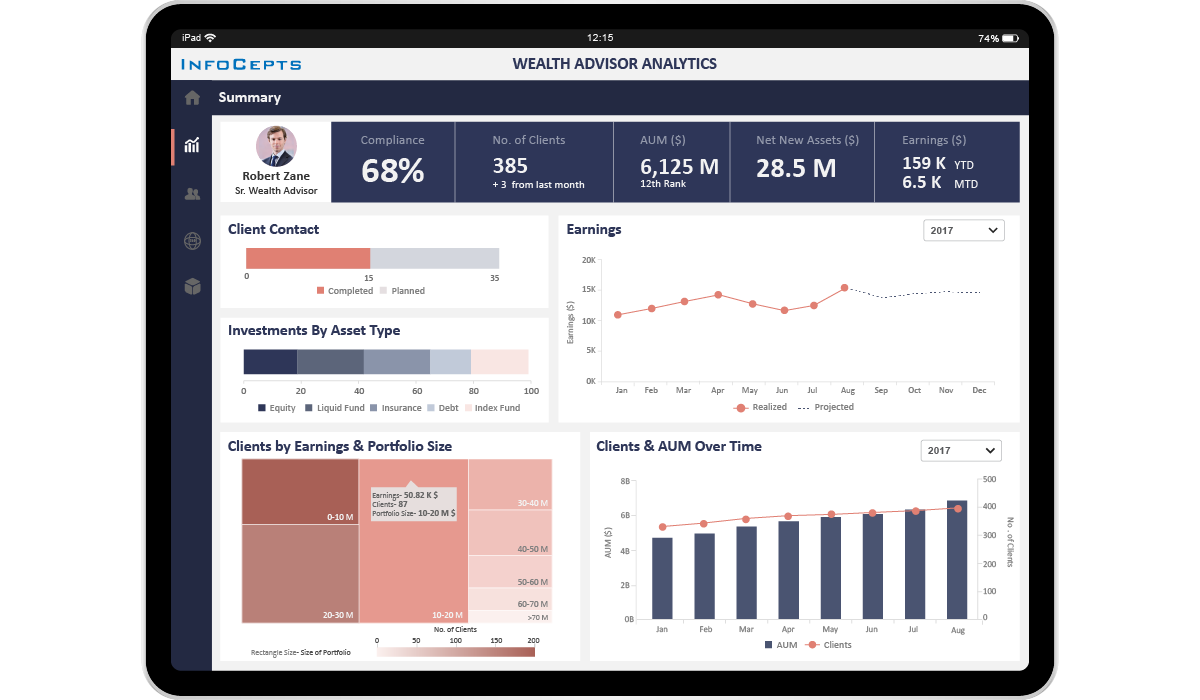

Wealth Management is undoubtedly in a period of constant change, motivated in part by changing investor preferences, regulatory developments, and evolving technologies. Wealth Advisor Analytics app provides actionable insights on the performance, product portfolio, and clientele of advisors. Using this app, wealth managers can plan their sales activities, target the right set of clients, and get all relevant information on fingertips during a client connect.

Challenges

Wealth Management is a discipline that incorporates financial planning, portfolio management , and a number of aggregated financial services offered by Wealth advisors. Some challenges are faced by Wealth Advisors in this highly-competitive corner of the wealth market are highlighted below :

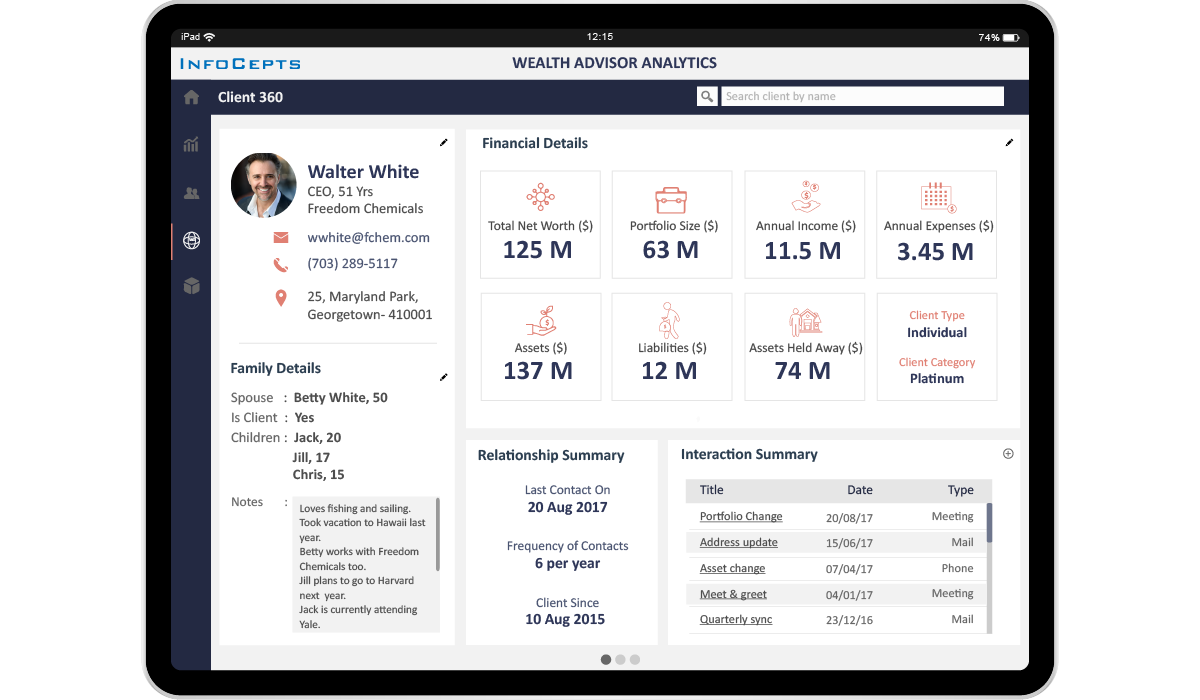

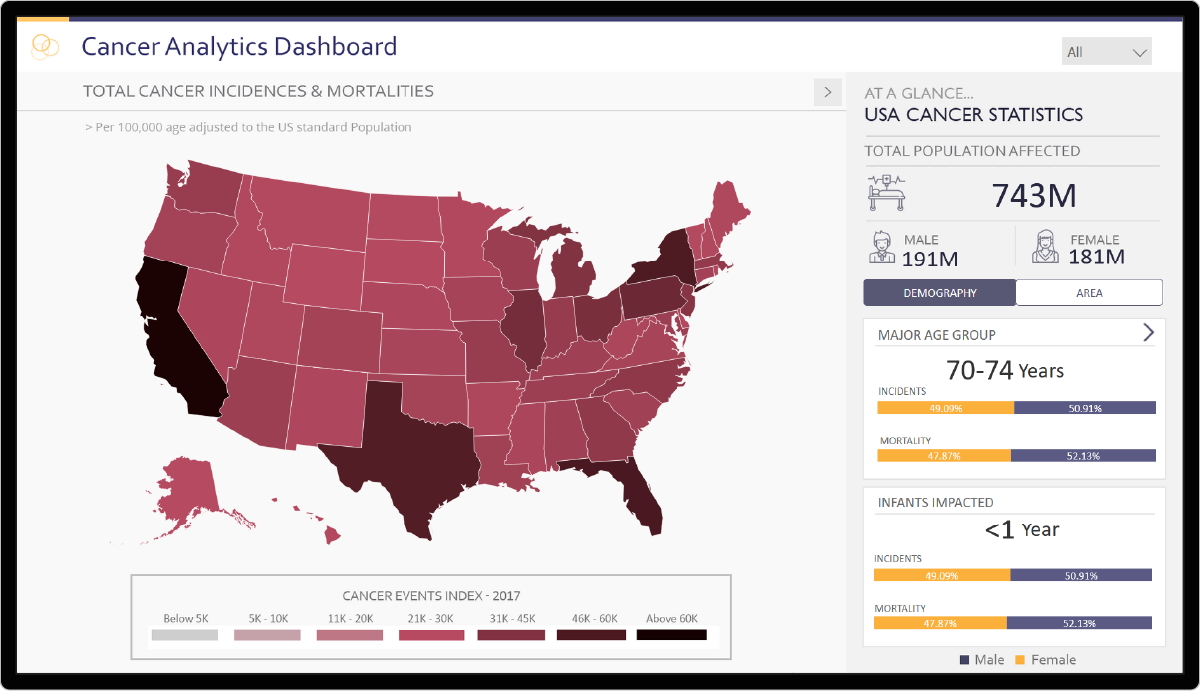

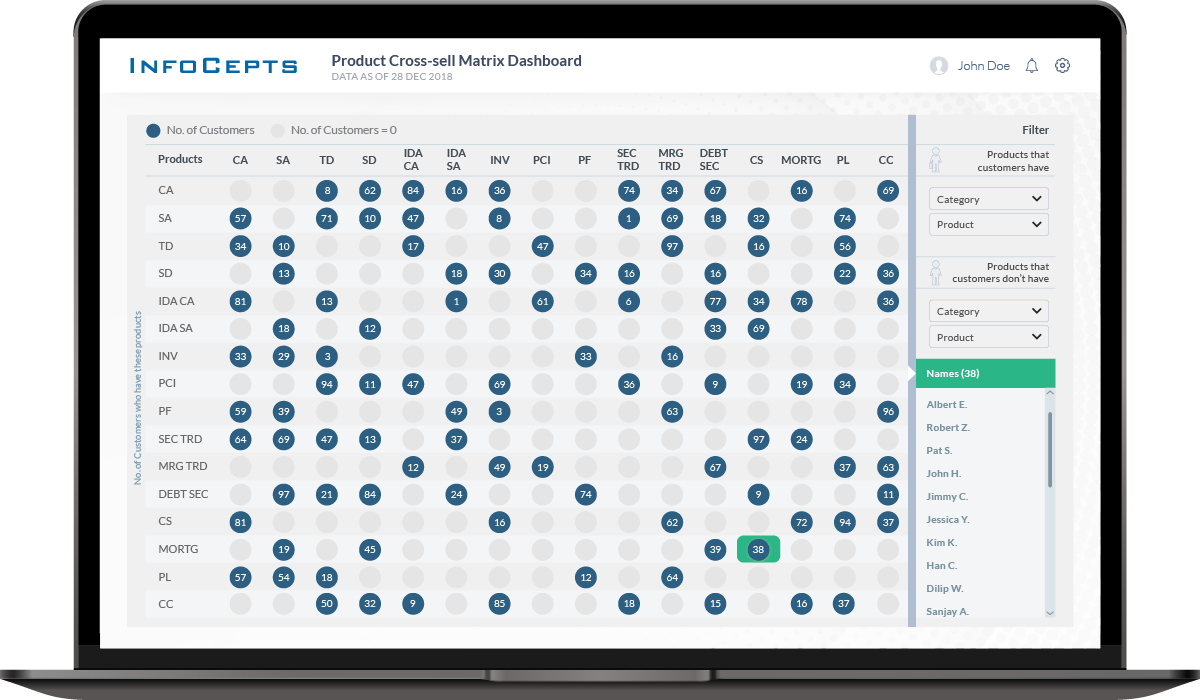

- Defining Client 360 View was a challenge to get an accurate and complete view of the client when a consistent client identifier has not been established. This hinders the sharing of client information globally, understanding the client profitability and the ability to identify the growing opportunities

- Alignment of asset and product classification at local and global level was a challenge because of difference in terms of assets across regions leading to client confusion

- Missing or incorrect data in fields are particularly prevalent in client profile information, especially when those fields are free-form. This may cause client service issues as well as pose a significant regulatory risk. Even in a highly digitized scenario where profile information is entered directly by the client themselves, a lack of guidance can result in incorrect or inconsistent data

Solution

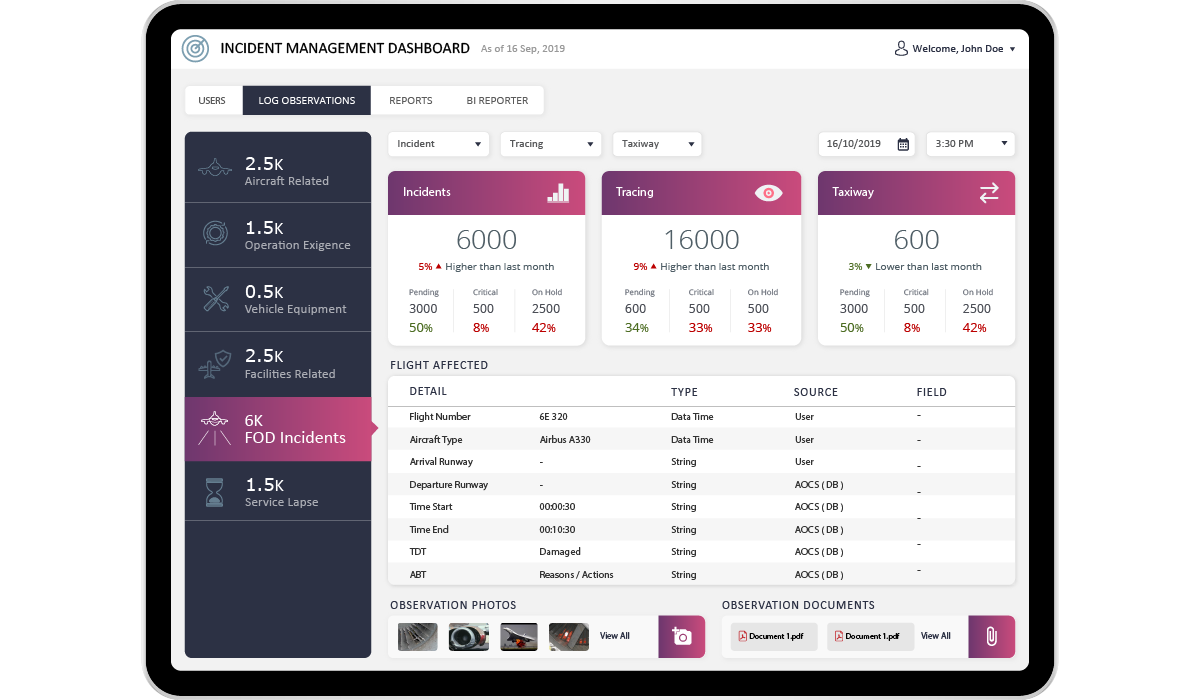

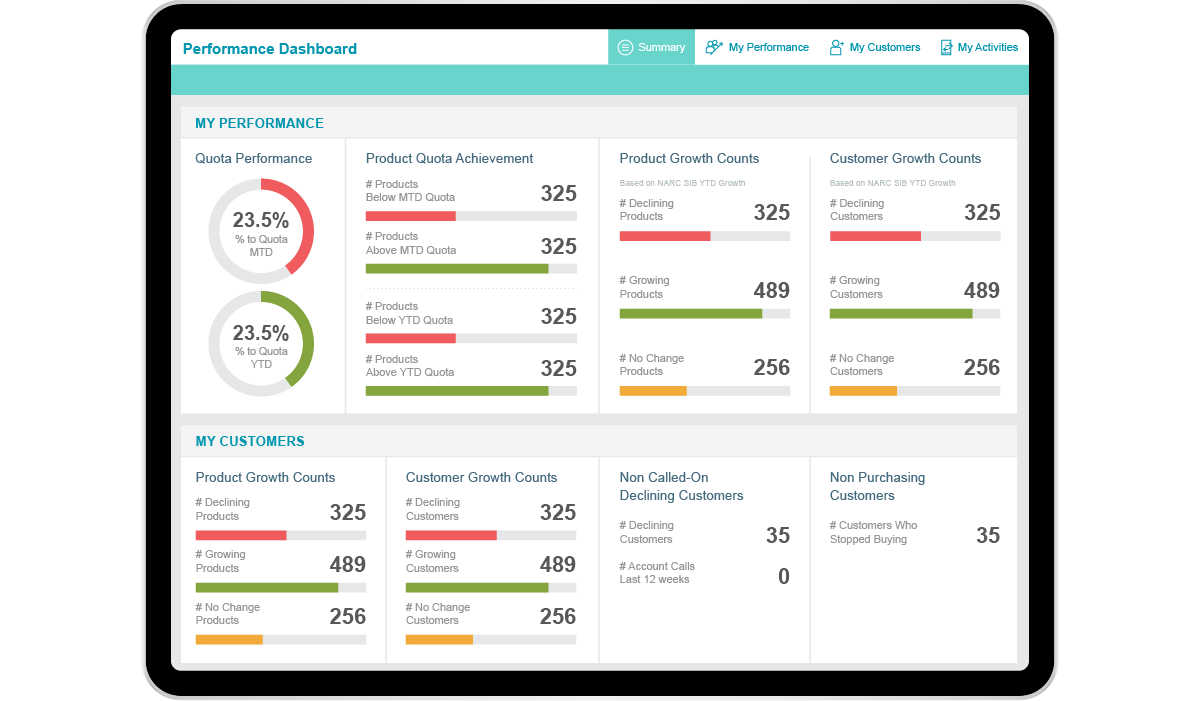

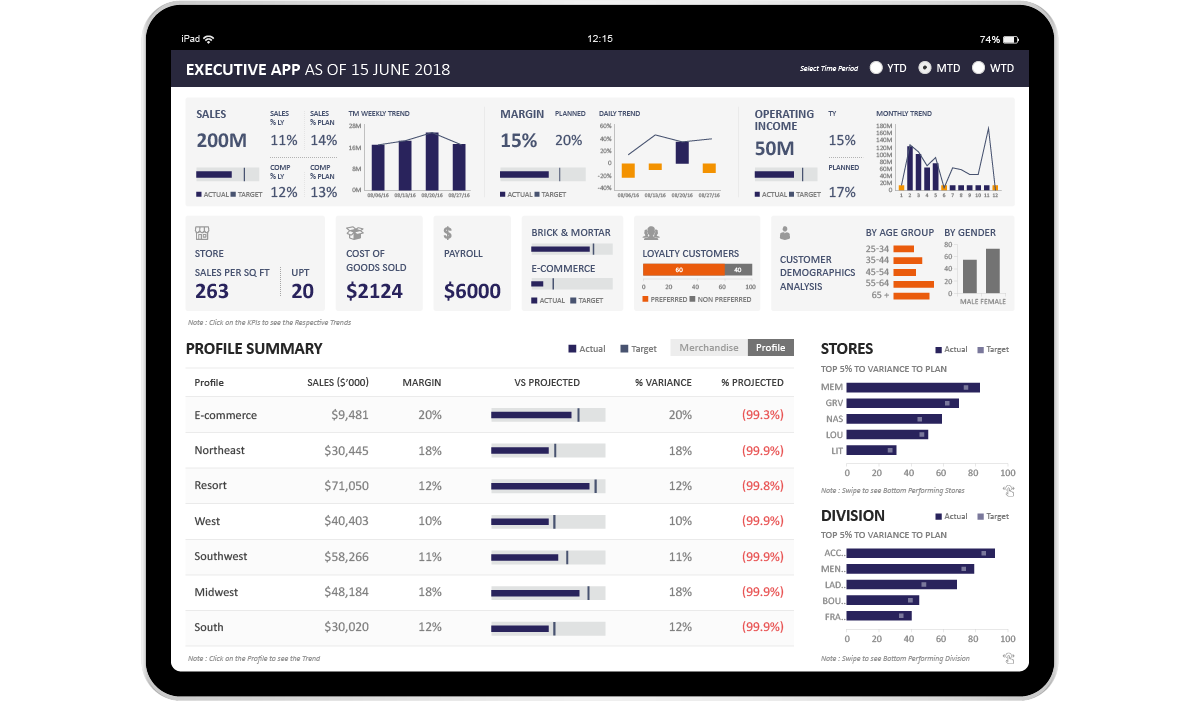

Following Insights were generated using the Wealth Advisor Analytics App

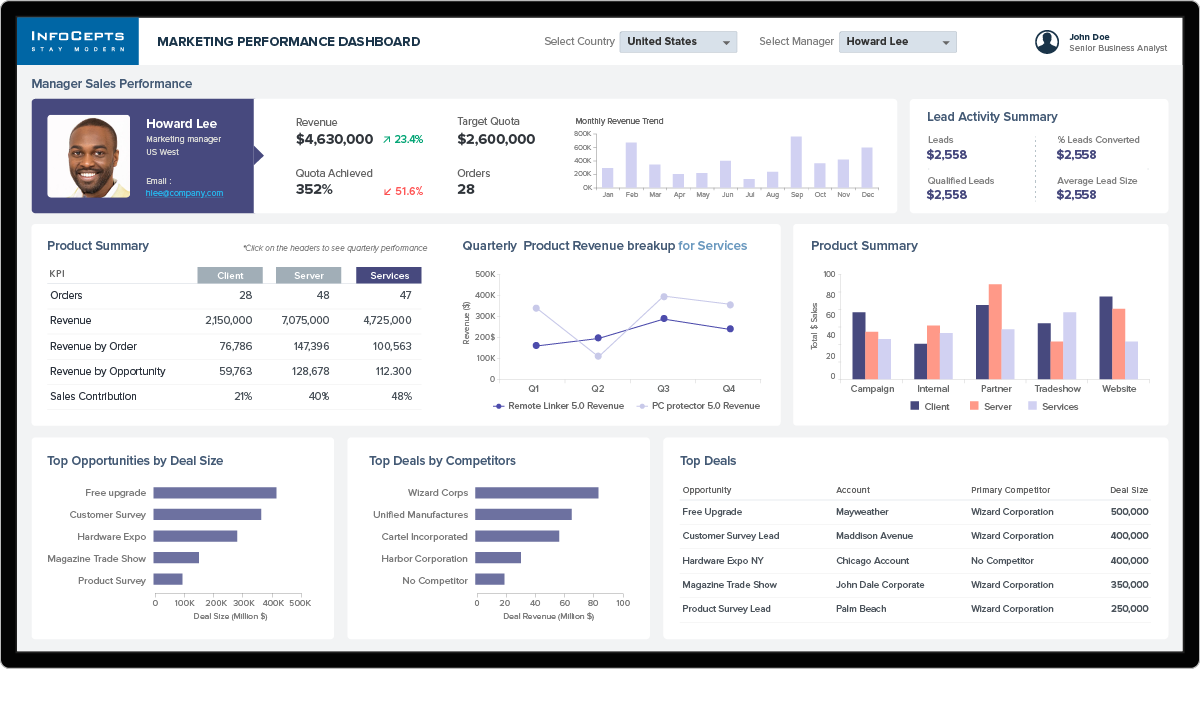

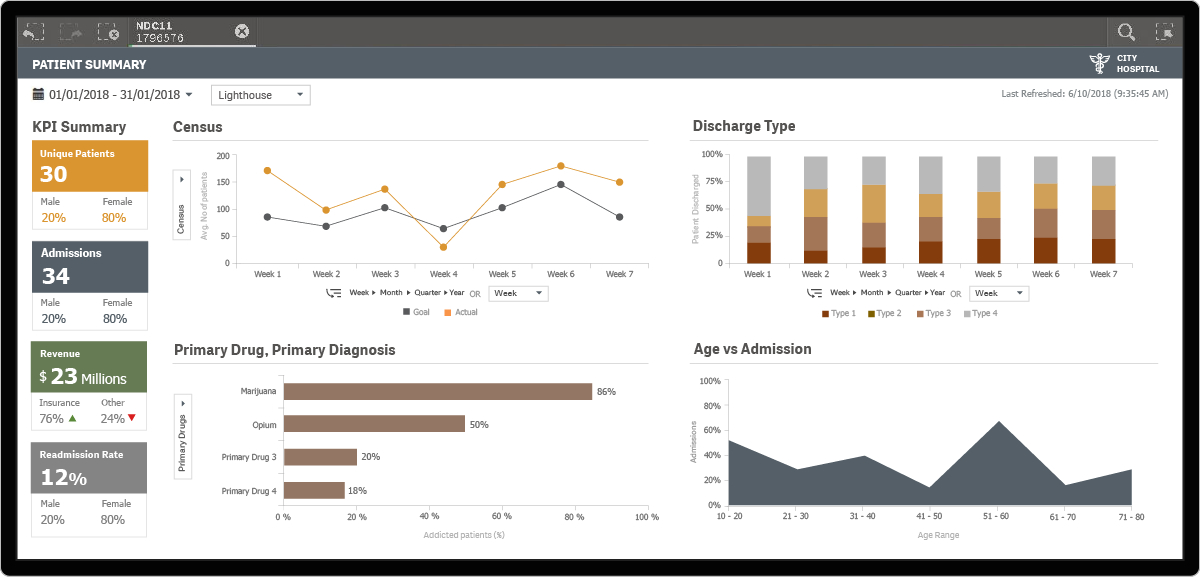

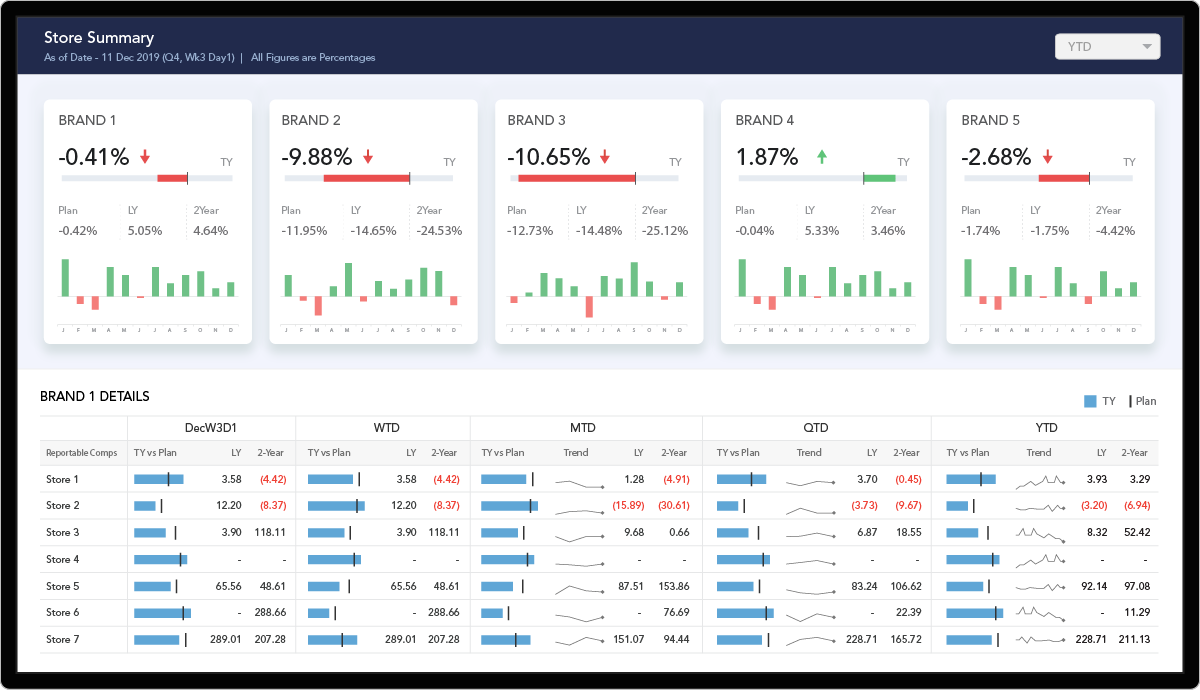

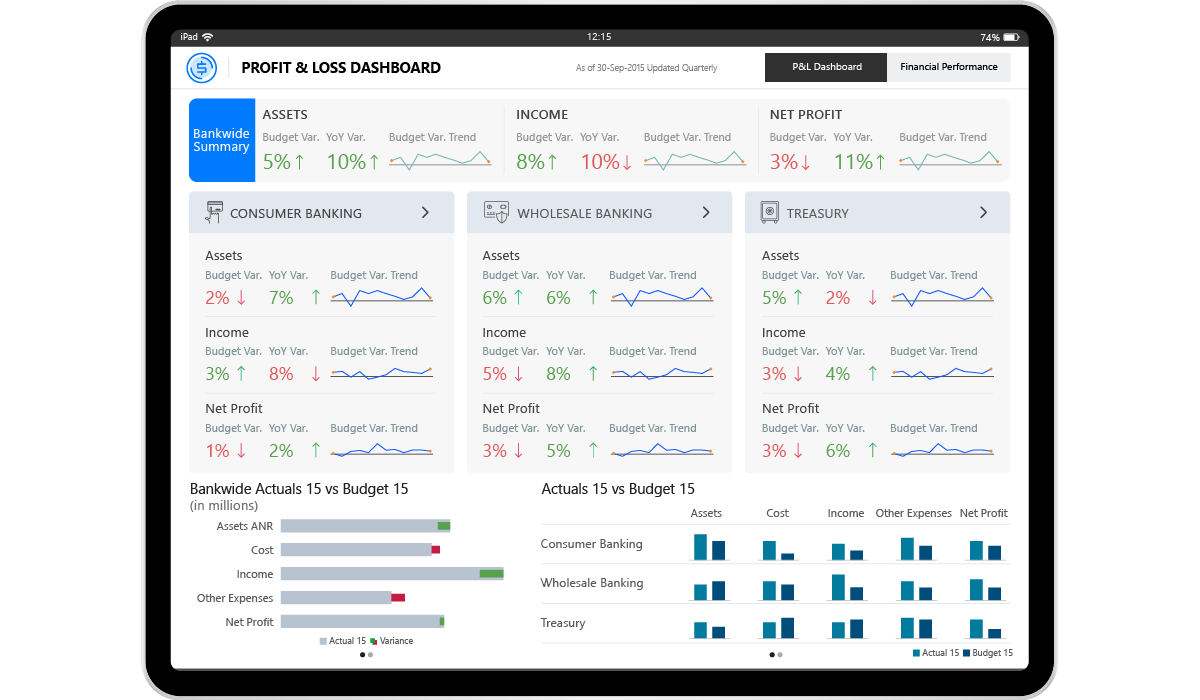

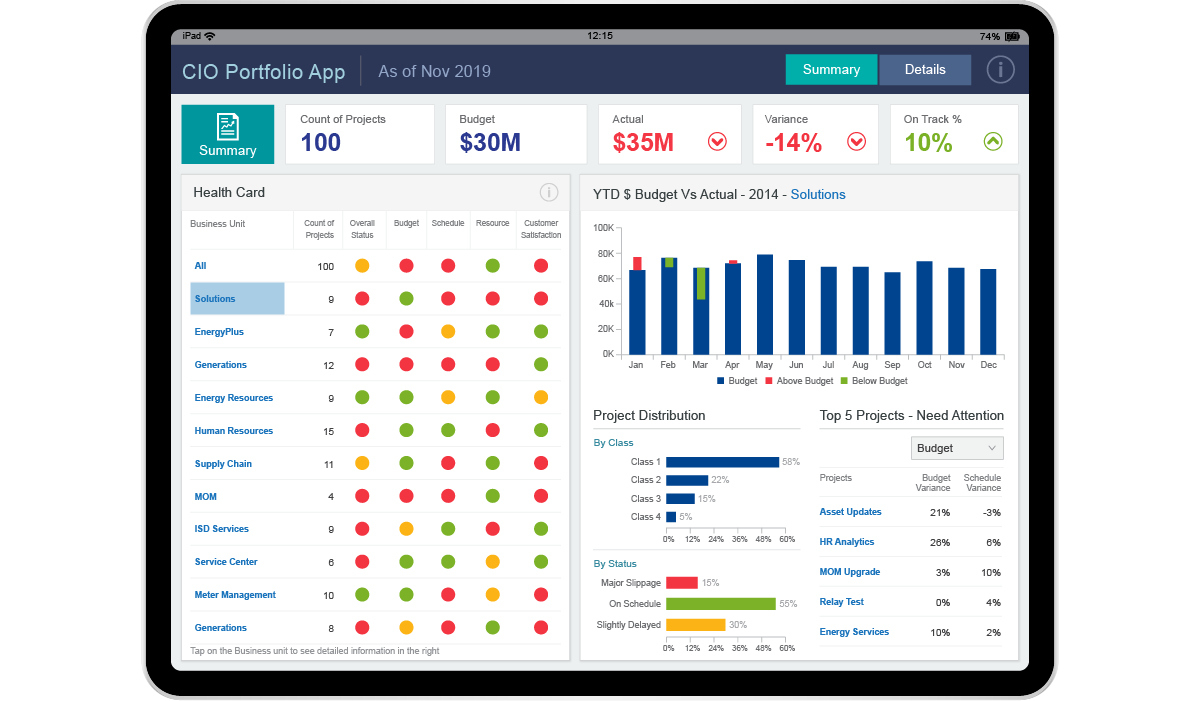

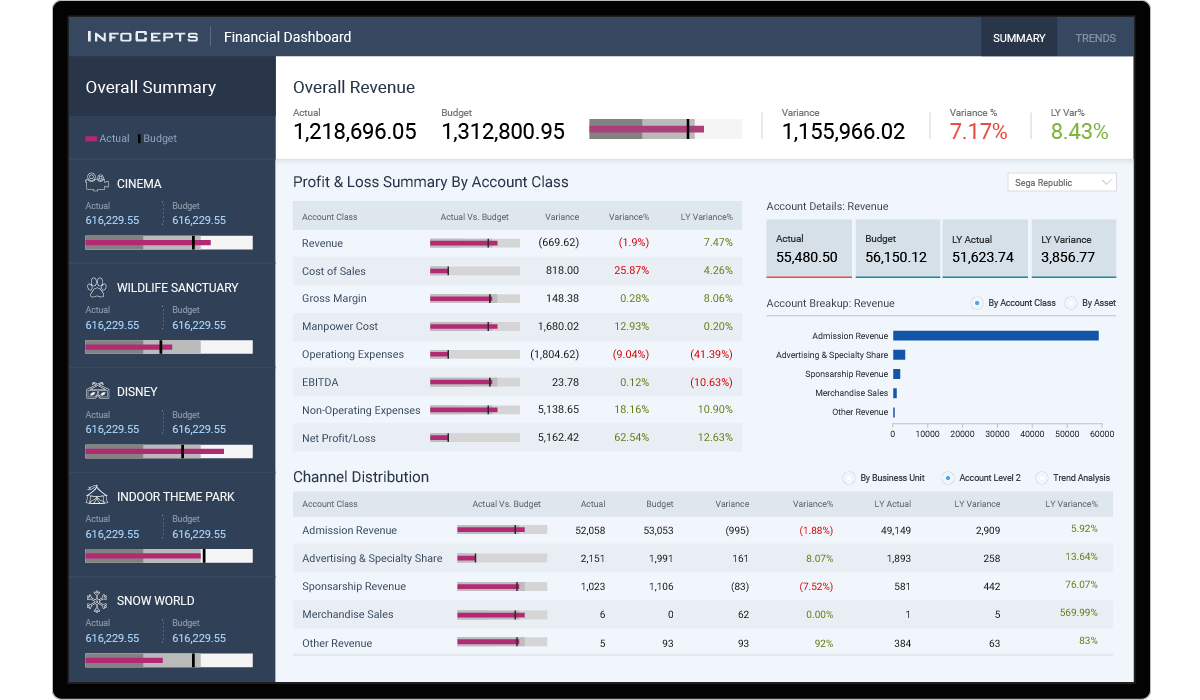

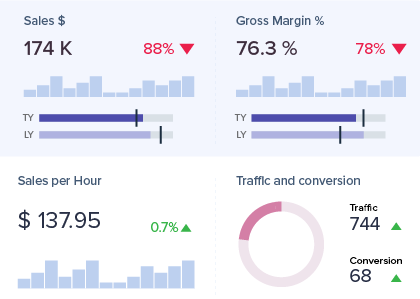

- Summarized view of Wealth Manager Profile with the information like no. of clients, Assets under management(AUM in $), earnings and portfolio size along with the monthly trends

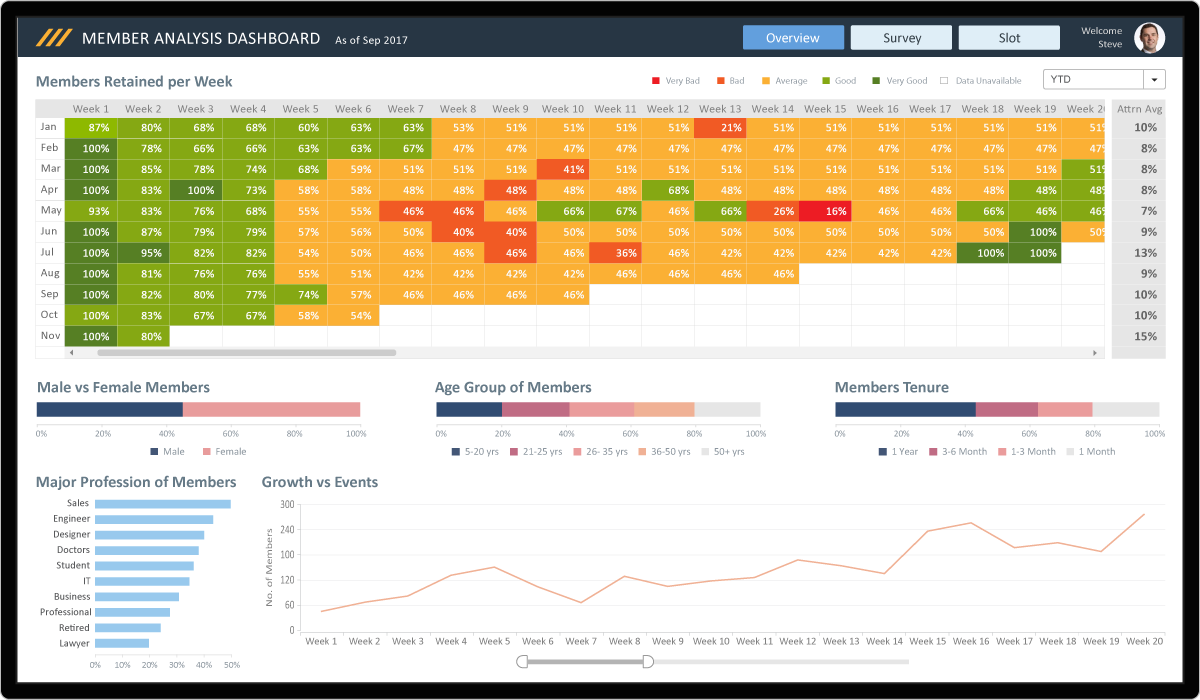

- Complete client information as a part of Client 360 view including family and financial details presenting KPIs like Total Net Worth, Portfolio Size, Net Income, etc. With relationship and interaction summary

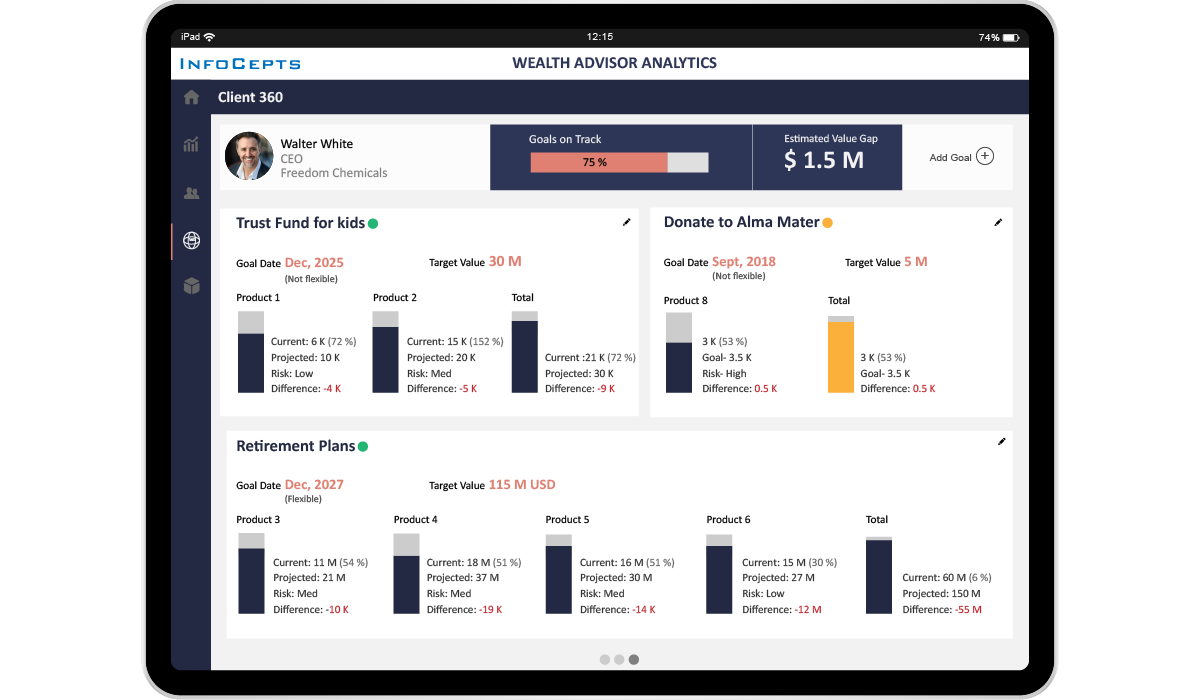

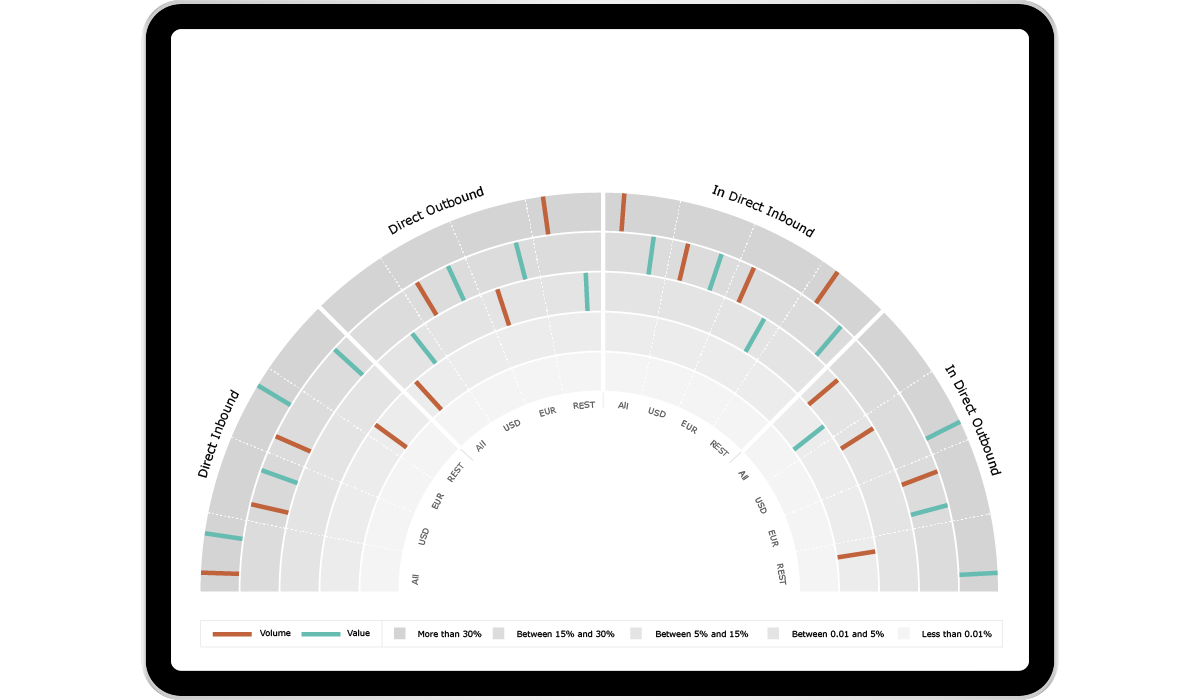

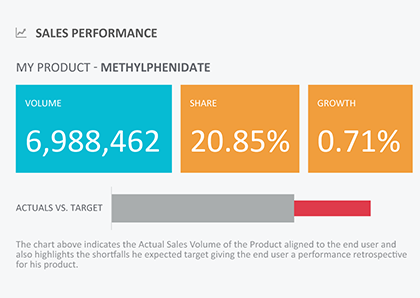

- Provided detailed Portfolio Summary as a part of a Client 360 view presenting the insights about asset and investment information and portfolio overview across months with KPIs like Portfolio Size, Accepted Risk, and Current Risk. This view also presented the performance of the products and targets achieved for each product invested by the client

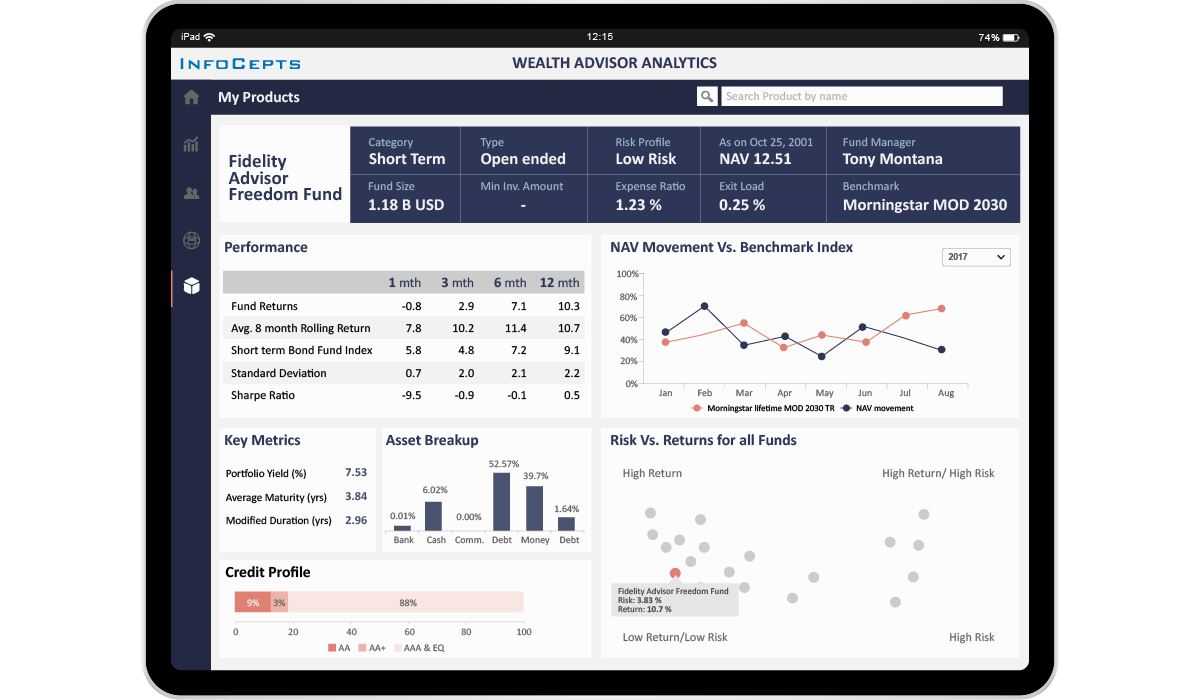

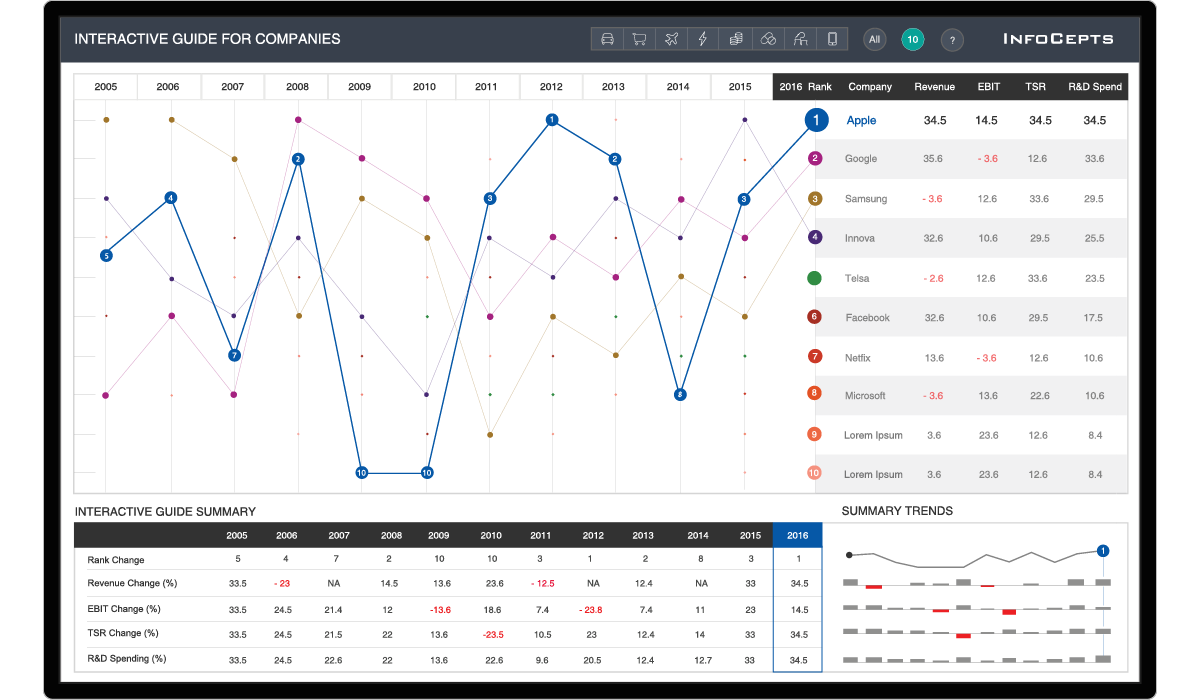

- Wealth Advisor can get detailed information of their products and its performance with Asset breakup, comparison of NAV Movement Vs Benchmark Index, Risk Vs Returns of all Funds which helped them to plan and target the product growth

- This Solution proved to be a single source system for acquiring information about clients and their assets along with the product performance, analyze the wealth manager to set proper client targets and plan sales activities enabling Improved Sales Targets and product performance with low risk

Increase in Sales

Increase in active clients

Increase in fee earned

Increase in response from client